Franchise Buyer Persona Profile: The ROI Driven Buyer

Our second installment in the Franchise Buyer Persona series looks at the ROI-driven franchise buyer. This franchise buyer has become one of the most important personas in modern franchise development. This is the candidate who approaches your brand like an investment committee would: with capital to deploy, a portfolio mindset, and a demand for clear, defensible returns.

Understanding this persona is no longer optional; it is central to attracting multi-unit operators, investor groups, and high-quality owner-operators who can scale your system. This article breaks down the ROI-driven buyer in depth—who they are, how they think, and what they want from a franchise relationship.

We’ll explore their demographic and financial profile, core mindset and risk posture, and the motivations that pull them toward franchising versus other asset classes. From there, we look at the types of concepts and deal structures they prefer, how quickly they move from first inquiry to commitment, and what their evaluation process actually looks like in practice.

Finally, we map the key pain points this persona faces and translate those insights into concrete marketing and sales strategies. You will see how to position your brand, structure your messaging, design an investor-grade discovery process, and build the kind of transparency and proof that ROI-driven buyers require before they write a check.

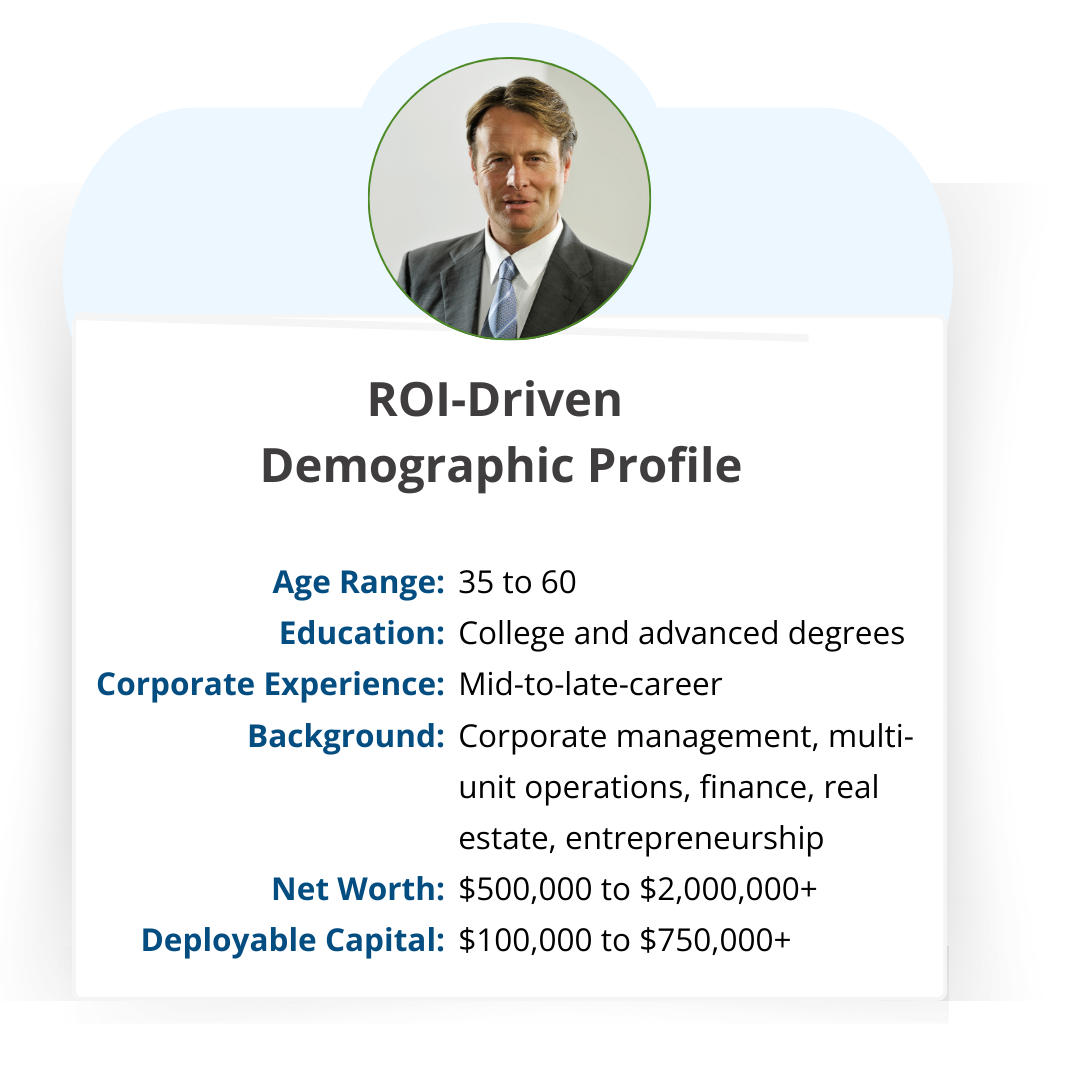

What is the Demographic Profile of the ROI Driven Franchise Buyer

ROI-driven franchise buyers are typically aged 35 to 60, placing them squarely in the mid- to late-career phase. These individuals bring significant business acumen, operational insight, and capital to the table. They are most likely to come from careers in corporate management, multi-unit operations, finance, real estate, or entrepreneurship. Many are former executives or serial entrepreneurs who are now channeling their experience into strategic investments.

This persona is most often found in large metropolitan or economically vibrant markets, where deal flow, multi-unit territory availability, and professional networks are strongest. They gravitate toward areas that offer not just consumer demand, but also the infrastructure and talent pools needed to scale effectively.

Financial Profile

Individual investors in this category typically have a net worth between $500,000 and $2 million or more, with $100,000 to $750,000+ in deployable capital per deal. In the case of family offices or small institutional players with similar ROI-driven goals, these numbers scale up significantly.

Their capital deployment strategy is intentional and growth-oriented, seeking franchise investments in the low- to mid-six-figure range per unit, with a clear path to multi-unit or area development.

What sets the ROI Driven persona apart is a high level of financial literacy and deal sophistication. They are accustomed to reading financial statements and structuring deals. To evaluate opportunities, the ROI Driven buyer actively uses metrics, including:

Payback period

Cash-on-cash return

Net present value (NPV)

Internal rate of return (IRR)

They expect robust, data-backed pro formas and look for franchisors who can articulate clear ROI benchmarks. deals.

Their risk posture is not anti-risk but anti-opacity. They are highly averse to poorly quantified risk and prefer concepts with strong historical performance, transparent Item 19 earnings data, and evidence of margin stability across cycles. They desire opportunities backed by a strong brand reputation, robust support, and defendable territories. This often makes them open to multi-unit or multi-brand holdings as individuals, family offices, or investor groups, so long as the systems and economics clearly support scale.

What Motivates the ROI Driven Persona to Buy a Franchise?

ROI-driven franchise buyers are motivated to purchase franchises when they see a clear path to strong, repeatable financial performance, backed by real data rather than narrative. Their primary lens is capital productivity: how reliably a concept can turn invested dollars into predictable, scalable cash flow.

Motivation: Financial

At the center of this persona’s motivation set is the pursuit of attractive returns with clear timelines. They are driven to achieve:

Strong ROI

Fast payback

Steady, predictable cash flow at the unit level

They prioritize brands that can demonstrate quick, proven ROI with realistic payback horizons and strong unit economics—high margins with manageable labor and occupancy costs and identifiable levers to improve profitability.

For these buyers, franchising is a way to maximize return on invested capital through a proven, replicable model as opposed to building from the ground up. Success is defined in terms of cash-on-cash returns, margin quality, and the ability to hit or exceed established financial benchmarks.

Motivation: Scale, Portfolio Building, and Wealth Creation

The ROI Driven buyer is highly motivated by the opportunity to build something larger than a single owner-operator location. They look for concepts that can grow into multi-unit or area development plays and explicitly prefer scalable, semi-absentee or manager-run portfolios over “buying a job.”

In this context, franchises are seen as portfolio assets: tools for compounding wealth, building a durable asset base, and creating multiple predictable cash-flow streams over time, often as diversification alongside real estate, equities, or other operating businesses.

Motivation: Risk Reduction, Control, and Transparency

A major part of what pulls ROI-driven buyers toward franchising is the promise of a de-risked, supported operating model. They are attracted to features that reduce startup uncertainty relative to independent ventures, including:

A tested playbook

Brand recognition

Training

Ongoing support

Transparency is a core motivator: they want robust Item 19 earnings data, clear FDD disclosures, access to detailed performance metrics, and validation calls to verify the real risk/return profile.

Control matters as well, but it is expressed as disciplined control over financial variables and growth decisions—controlling their “own destiny” by managing capital allocation, cost structure, and scaling cadence rather than purely lifestyle autonomy.

Motivation: Operational Leverage and Strategic Appeal

Operational leverage is another strong motivator for this persona. They value systems that allow professional managers to run day-to-day operations, so they can focus on strategy, performance management, and scaling the portfolio.

Strong franchisor support is especially compelling because it reinforces the sense that the model can be optimized and replicated. That support should come in the form of items that directly drive revenue and profitability, including:

Training

Marketing engines

Technology platform

Performance coaching

They also prefer brands and categories with resilience and defensibility, seeking concepts positioned to withstand economic shifts and competitive pressures so that the underlying cash flows and margins are more stable over time.

Motivation: Psychological and Professional

Psychographically, these are achievement-driven professionals who are willing to work long hours and make complex decisions when there is a clear payoff and leverage via systems, staff, and processes. They derive satisfaction from mastering a model. Optimizing operations, improving margins, and “beating the benchmarks” function as important positive drivers alongside the financial outcomes.

They often juggle multiple investments, so structures that enable leverage—capable managers, clear KPIs, and dashboard-style oversight—align with their desire to operate at a portfolio level rather than as single-unit operators.

Their approach to franchising is pragmatic and analytical: they see it as a strategic vehicle for income and wealth creation, are comfortable deferring early lifestyle benefits to optimize long-term ROI, and remain skeptical until independent validation (franchisee conversations, benchmarks, third-party data) confirms that the systems and economics truly support scale.

What Kind of Franchises Draw ROI Driven Buyers?

ROI-driven franchise buyers gravitate toward franchise models and deal structures that maximize capital efficiency, scalability, and risk-adjusted returns. Their preferences show up clearly in the types of concepts they pursue, how they run their evaluation process, and how they relate to franchisors once in the system.

This persona favors concepts with documented top‑quartile and average returns, robust unit economics, and a consistent history of strong owner earnings. They look for industries that generate recurring or subscription-like revenue, demonstrate strong customer retention, and offer defensible local market positions, because these attributes support more predictable cash flow and protect margins over time.

Structurally, they prefer opportunities that support scale. Multi-unit, territory, or regional development rights are attractive when they allow economies of scale in management, marketing, and back-office operations, improving overall ROI as the portfolio grows.

Brands that offer strong support systems, training, and marketing are particularly appealing because they can accelerate ramp-up, reduce execution risk, and help safeguard the performance of each incremental unit.

The ROI Driven franchise buyer is most likely to invest in:

Staffing & recruitment

Home services (lawn, pest, cleaning, remodeling)

Senior care & healthcare services

IT & business services

Food & beverage (QSR / fast casual)

How Quickly Do ROI Driven Buyers Commit?

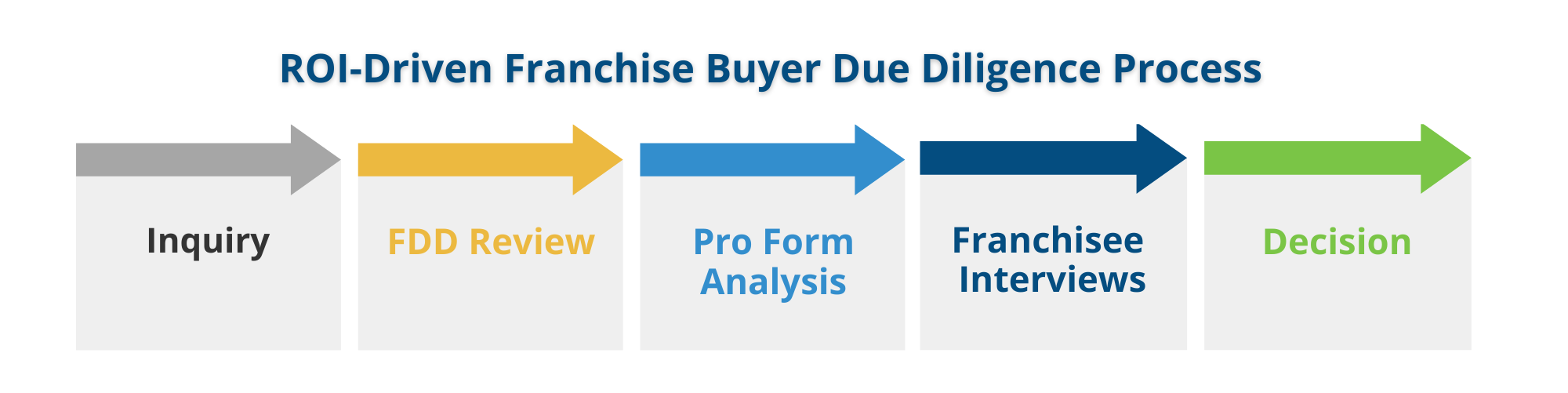

ROI-driven franchise buyers follow a deliberate, evidence-based path from first contact to commitment, with clear phases and defined decision gates. Their timelines are shaped by how quickly they can validate the numbers, test assumptions, and compare a franchise to competing investment options.

Overall Decision Horizon

Once seriously engaged, ROI-driven buyers often move from active evaluation to commitment within roughly 1–3 months, provided the numbers hold up, and capital is already in place. Their process is disciplined and structured; they:

Review data and the FDD

Build or scrutinize financial models

Hold multiple conversations with existing franchisees

Benchmark the opportunity against other investments in their pipeline

They can move quickly when the model and risk profile are validated, but their tolerance for ambiguity is low. If they encounter a lack of transparency, unrealistic assumptions, or gaps between narrative and numbers, they will exit the funnel abruptly rather than “wait and see.”

What Pain Points Do ROI Driven Buyers Face as Franchise Owners?

ROI-driven franchise buyers experience a distinct set of pain points around information quality, capital risk, operational execution, and the behavior of franchisors. These challenges all relate to a single core fear: committing significant capital and time to a model whose real-world performance does not match the story on paper.

Pain Point: Information, Transparency, and Trust Gaps

This persona is deeply skeptical of marketing claims that are not backed by vetted data and clear disclosures. They are frustrated when FDD earnings data, unit-level P&Ls, or benchmark KPIs are limited, selectively presented, or difficult to interpret, and when projections are not clearly tied to underlying assumptions.

Concerns are amplified in newer or fast-growing brands that lack a long track record. The absence of historical data makes it harder for the ROI-Driven buyer to reconcile projections with actuals and to assess whether results are repeatable.

The ROI Driven buyer is also sensitive to broader industry issues highlighted in risk and regulatory reports. Systemic patterns such as high and rising fees, one-sided contracts, and franchisor practices that can make it “impossible” for some franchisees to earn a good living magnify perceived downside for ROI-focused investors. When disclosures are vague, fees are fragmented or hidden, or earnings representations feel overstated, this persona sees a “black box” and becomes highly reluctant to proceed.

Pain Point: Capital Risk, Cash Flow, and Timing

Financially, ROI-driven buyers worry about tying up large amounts of capital in location-based assets that can be difficult to liquidate quickly if performance disappoints. Franchise risk and ROI analyses call out the danger of overestimating returns due to optimistic projections, high fee loads, and underestimated operating costs, which is especially problematic for investors who rely on precise ROI calculations. They fear making a poor, hard-to-reverse capital decision or overpaying for a weak model that fails to deliver acceptable risk-adjusted returns.

Underestimated total investment is a recurring pain point. Build-out overruns, additional working-capital needs, technology requirements, staffing costs, and other “surprise” expenses can push real investment well above advertised ranges.

Cash-flow timing is just as important as the overall numbers. If sales grow more slowly than expected, early costs are higher, or the business takes longer to stabilize, it takes longer to earn back the investment, and the overall return goes down, especially in slower-moving industries. Moreover, buying and opening a franchise can take months to over a year when research, application, funding, and build-out are included, which ties up capital and introduces timing risk that these investors must price in.

Pain Point: Operational and Scaling Risks

On the operational side, ROI-focused owners worry about whether the franchise system truly supports multi-unit growth without eroding margins. Labor availability, operating complexity, and the robustness of systems for hiring, training, marketing, and field support all factor into their concerns about scalability. If the operational playbook is weak, inconsistent, or overly dependent on exceptional local operators, the model’s ability to scale profitably is called into question.

The ROI Driven buyer also pays close attention to franchisee satisfaction and support quality, recognizing that poor franchisor support can drag down returns even in otherwise strong categories. Research and advocacy sources point to issues such as weak support, unclear playbooks, or over-awarded/saturated territories as drivers of underperformance and conflict, which are seen as direct threats to ROI.

Misalignment between franchisor ownership or private equity priorities and franchisee profitability—where short-term system-level extraction trumps unit economics—is another strategic pain point that heightens perceived risk.

Pain Point: Cognitive Load, Choice Overload, and Process Friction

Even with strong financial skills, ROI-driven investors face the challenge of navigating a crowded and complex franchise market. With thousands of concepts and a wide variation in disclosures, they can feel overwhelmed by options and frustrated by generic pitches that lack hard data and clear differentiation. The absence of clear, comparable ROI data across brands and inconsistent ways of presenting investment and performance metrics add to evaluation friction.

Process quality on the franchisor side is a pain point as well. Slow or inconsistent follow-up, disorganized information delivery, and difficulty accessing decision-critical documents and franchisee references all work against this persona’s structured evaluation style. When franchisors cannot or will not provide timely, coherent responses and documentation, these buyers interpret it as a signal of deeper organizational issues and disengage.

How Pain Points Show Up in Their Behavior

Taken together, these pain points manifest as heightened sensitivity to risk signals and a low tolerance for ambiguity. ROI-driven buyers are particularly wary of:

Overstated earnings

Hidden or escalating fees

Unclear support obligations

Territories that limit growth potential

Their aversion to chaos and “black box” brands means they are quick to walk away from opportunities where economics, support, or culture are not clearly articulated, validated, and aligned with their expectations for a professional, performance-driven partnership.

How to Market To and Attract the ROI Driven Buyer

ROI-driven franchise buyers respond best to marketing that treats them like investors, not just leads. They want hard numbers, clear risks, and a professional, data-rich process from first click to close.

Lead with Data, Not Hype

This persona is looking for serious information about what it means to buy into your system—benefits, support, training, and especially unit-level economics—rather than high-level brand stories or lifestyle images. Content that explains how to analyze franchise ROI directly serves how they make decisions. Examples of this type of content, include

Investment breakdowns

Profit drivers

Breakeven points

Payback analysis

Transparent discussion of timelines, fees, and financing realities builds credibility with analytical candidates and reduces early skepticism.

Use Performance-Focused Channels and Content

Research on franchise lead development indicates that ROI-driven prospects respond strongly to performance-focused content when they are already searching for opportunities. High-impact channels include:

Search and performance ads (Google/Bing) around “best franchise ROI,” “high cash flow franchise,” and sector-specific ROI queries.

High-intent SEO content and landing pages optimized for franchise opportunity and ROI-related keywords.

Targeted LinkedIn and financial or business media placements where investors research opportunities and capital deployment.

Within these channels, the most effective content formats are:

Detailed, digestible FDD / Item 19 and unit-economics explainers (with appropriate disclaimers) that walk through margins, costs, and revenue drivers.

Interactive ROI calculators and downloadable pro forma templates so prospects can run their own scenarios with their capital and assumptions.

Webinars or videos on unit economics, “how the top 10% of franchisees perform,” and “path to multi-unit scale,” anchored in actual data.

Positioning and Messaging that Lands

Messaging to ROI-driven buyers must lead with financial clarity, scalability, and risk management rather than passion or lifestyle narratives. Resonant themes include:

“High margins, predictable cash flow, and a clear path to multi-unit scaling.”

“Low overhead and strong unit economics make scaling both predictable and profitable.”

“Track record of above-industry returns with transparent financial visibility and robust support infrastructure.”

What to emphasize:

Proof points: historical averages, same-store sales trends, failure/closure rates, ramp-up times, and performance bands framed compliantly.

Risk controls: selective territory awards, clear playbooks, strong training, ongoing field support, and data-driven marketing systems.

Design the Sales Journey as an Investment Process

For this persona, the sales process should feel like an investment committee workflow rather than a traditional “discovery day” pitch. The ROI-Driven buyer makes decisions using structured evaluation: models, checklists, scenario analysis, and direct validation from existing owners. Effective steps include:

Early lead qualification around capital, investment horizon, portfolio strategy, and risk tolerance, to position the opportunity appropriately.

Providing a structured data pack: FDD overview, sample P&L, investment breakdown, key KPIs, and territory maps in a concise, comparable format.

Nurture tactics that work:

Email sequences that move from high-level performance snapshots to deeper financial disclosures and then into case studies and cohort performance snapshots.

Thought-leadership assets such as “unit economics deep dives,” “10-year ROI case study,” or “how to benchmark franchise returns,” used as lead magnets.

Facilitated franchisee validation conversations—ideally with mid-pack as well as top performers—focused on ramp-up, support quality, and real-world ROI experience.

Channel choice should reflect where serious, capital-ready prospects already are:

LinkedIn, financial and business media, targeted investor lists, and franchise/investment portals where buyers self-select in.

Small-group or 1:1 virtual sessions with development leaders or top-performing franchisees framed explicitly as due diligence briefings, not sales webinars.

Throughout, the ROI-Driven persona responds to rational persuasion supported by credible social proof: data, logic, and structured case studies, reinforced by testimonials and stories from similar investor-type owners.

When your marketing, messaging, and sales process consistently deliver that kind of investor-grade experience, you are far more likely to attract and convert ROI-driven franchise buyers.

Final Thoughts

The ROI-driven franchise buyer is not a hypothetical construct; this persona is already shaping how capital flows into franchise systems and which brands scale most effectively. When franchisors understand a buyer’s demographics, financial profile, mindset, motivations, and pain points, they can design far better offerings and disclosures that stand up to rigorous scrutiny. They also make it much easier to convert sophisticated prospects into high-performing multi-unit partners.

Franchises that cannot meet this standard of clarity, transparency, and operational discipline will increasingly find themselves filtered out early in the evaluation process.

Stay tuned for next month’s article, where the series will continue with another key buyer persona. Don’t forget to review the Corporate Refugee Franchise Buyer Persona from last month.